‘Tis the season when the tidings come in envelopes stamped “Important Tax Return Document Enclosed.” Yes, it’s tax filing season, and the season’s Grinches are the tax identity thieves and government imposters who are hoping to steal your money.

Tax identity theft happens when someone uses your Social Security number (SSN) to file a phony tax return and collect your refund.

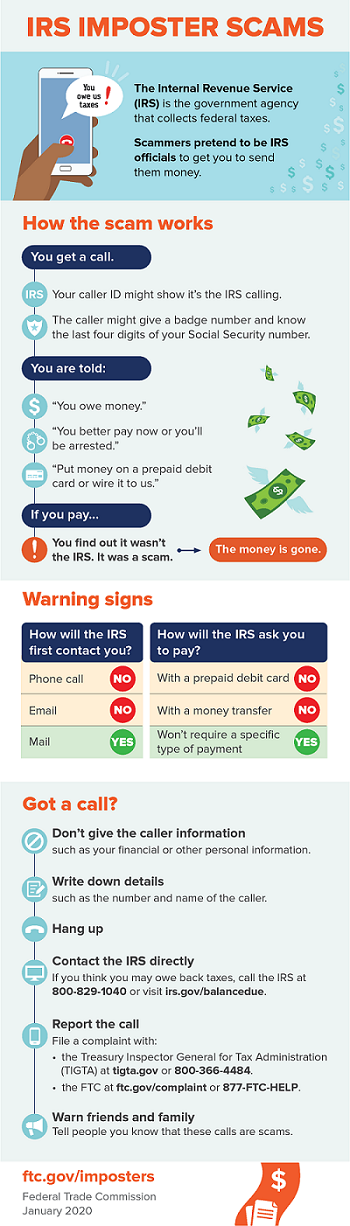

IRS imposters are scammers who pretend they’re calling from the IRS. They claim you owe taxes and demand that you pay right now, usually with a gift card or prepaid debit card. They threaten you’ll be arrested or face other bad consequences if you don’t pay. But it’s all a lie. If you send the money, it’s gone.

Even worse, with some types of tax identity theft, you may not find out about it until you try to file your tax return and the IRS rejects it as a duplicate filing. While the IRS investigates, your tax refund can be delayed. The misuse of your SSN means you also may be at risk of other types of identity theft.

What you need to know in 49 seconds

The FTC has his awesomely fast video that has everything you need to know about these scams:

https://www.youtube.com/watch?v=i4nCy6Xs6R8

Quick Reference Guide

If that was too fast, the FTC has this handy infographic for you (perfect for posting near your phone as a reminder):

Start Fighting NOW

To start fighting tax identity theft right away:

- Protect your SSN throughout the year. Don’t give it out unless there’s a good reason and you’re sure who you’re giving it to.

- File your tax return as early in the tax season as you can.

- Use a secure internet connection if you file electronically, or mail your tax return directly from the post office.

- Research a tax preparer thoroughly before you hand over personal information.

- Check your credit report at least once a year for free at annualcreditreport.com. Make sure no one has opened a new account in your name.

For More Information

- Read the FTC’s article on Tax-Related Identity Theft.

- Visit the IRS’s Taxpayer Guide to Identity Theft.

Guest blogger: Seena Gressin with the FTC

No comments yet.